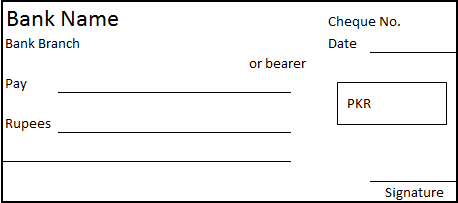

Cheque is an instrument in

writing containing unconditional order, drawn on a banker, sign by the drawer,

and payable on demand. It is used to withdraw money deposited in the bank.

Following are the essentials of a cheque.

1. It must be in

writing.

2. It must be drawn on a

banker.

3. It must be in the form

of an order.

4. The order must be

unconditional.

5. It must be signed by the

drawer.

6. It must be payable

on demand.

7. The amount in the cheque

must be certain sum of money.

8. The payment must be made to

a person, bearer, or self.

Kinds of Cheque

1. Bearer Cheque:

A cheque which is payable to

any person who presents it at the counter of the bank is known as bearer

cheque. It can be transferred to another person by mere delivery. However, it’s

a risky cheque because if it is lost, the finder of it can receive cash

from the bank.

2. Order Cheque:

A cheque which is payable to a

person whose name is mentioned in it is called order cheque. In order cheque

the word “bearer” is cancelled. It can be transferred to a third person by the

order of the original payee.

3. Cross Cheque:

When a cheque is crossed by

drawing two parallel lines on the face it becomes crossed cheque. Such cheque

cannot be cashed at the counter of the bank. It is only be credited to the

payee’s account. It has the following kinds.

a. General crossing

b. Special crossing

General Crossing: When a cheque is crossed by drawing two parallel

lines on the face of it with additional words like “Payees A/c Only” or “Not

Negotiable” or “& Co”.

Special Crossing: When a cheque is crossed by drawing two parallel

lines on the face of it with a particular bank name.

4. Open Cheque:

When a cheque is not crossed

it is called an open cheque. Such a cheque can be cashed at the counter of the

bank. It may be a bearer or an order cheque.

5. Pay Order:

When a bank orders another

bank to pay a certain sum of money to a third party it is called pay order. It

is applicable for payment within a city. The bank issues a pay order to the

person who request for it and deposits sum equal to pay order plus bank

charges. Pay order provides guarantee that payment will be made by bank. It is

also known as banker’s cheque.

6. Demand Draft:

It is a cheque issued by one

bank in one city or country to another city’s or country’s bank in favor of a

third person. It cannot be dishonored as the amount is paid before. It is generally used to make payment outside a city.

Reasons for Dishonor of Cheque

Bank can dishonor the

cheque due to following reasons.

1. Irregular signature:

When the drawer signature does

not match with the signature bank has in its record. The bank will not accept

the cheque for payment.

2. Insufficient Amount:

When the fund is not enough in

drawer’s account to meet the cheque for payment, the cheque will be bounced.

However, in case of overdraft facility, bank can accept the cheque.

3. Insanity:

The bank will not accept the

cheque, if the accountholder gets insane and bank receives notice of insanity.

4. Bankruptcy:

When the accountholder is

unable to pay of his debts in full, and this bankruptcy is declared by the

court of law, the bank will not honor a cheque presented on behalf of such

accountholder.

5. Post-dated Cheque:

When a cheque is presented to

the bank for payment before the date written on it is called posted-dated

cheque. This kind of cheque cannot be cashed till that date arrives.

6. Stale Cheque:

The cheque which is older than

six months is known as stale cheque. The bank does not accept such a cheque.

7. Death:

When the accountholder draws a

cheque, and before it is presented to the bank, he dies, and bank receives such

information, the bank will dishonor the cheque.

8. Frozen Account:

If the customer account is

frozen by the court of law, the bank will not honor the cheque on behalf of

that customer.

9. Drawer’s Revocation:

If the accountholder draws a

cheque and issues it, after he directs bank not to make payment for such a

cheque, the bank will not accept it.

10. Alteration:

If any alteration in the

cheque is made and is not confirmed by the drawer by his signature, the bank

will dishonor it.

This was really helpful!

ReplyDelete<3